Let’s see how these red flags show up in phishing scams.

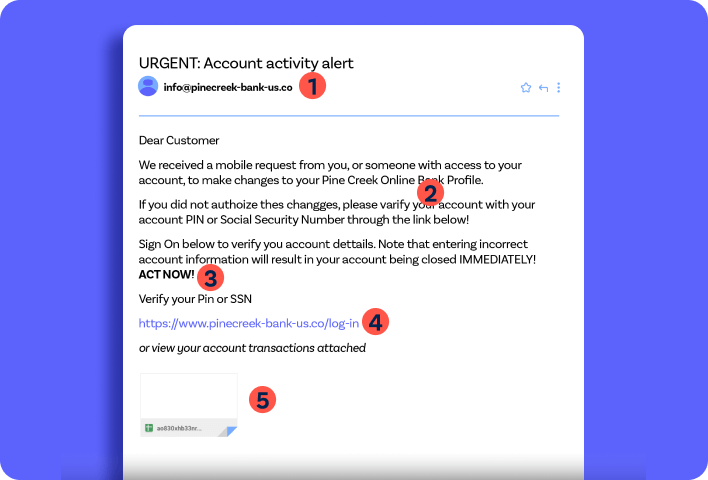

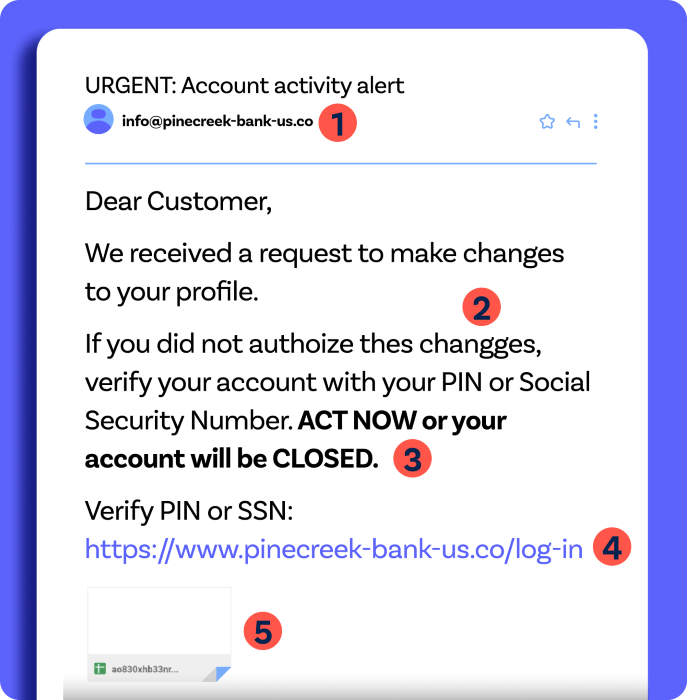

Email Scams

Unusual Email Address

Slow it down. Does that look like an email address your bank would use? Be wary of unexpected emails from addresses that aren’t like the ones your bank typically employs.

Misspelled Words

Spot check! If you see misspelled words or odd grammar, they are all clear signs of an impersonator. Real banks use spell check.Scare Tactics

Don’t panic. If an email uses scare tactics, such as urgent warnings of account closure or security breaches, you can safely assume it’s a scam.Suspicious URLs

Hold up — banks will never ask you to log in via email. Phishing emails use deceptive URLs to take you to malicious websites. Never click links that you weren’t expecting.Unexpected Attachments

Something’s phishy, because real banks will never send an email attachment — especially when you didn’t ask for it. Attachments can contain malware that can compromise your computer or personal information. Never click on attachments from emails supposedly from your bank.

Email Scams

1. Unusual Email Address

2. Misspelled Words

3. Scare Tactics

4. Suspicious URLs

5. Unexpected Attachments

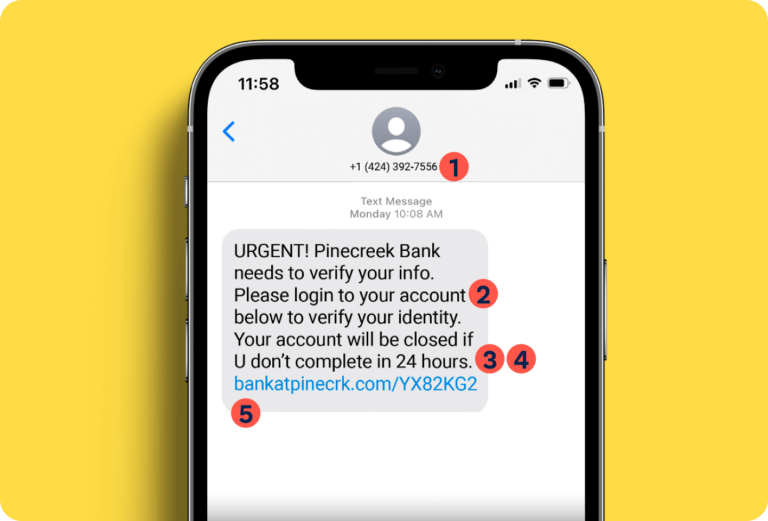

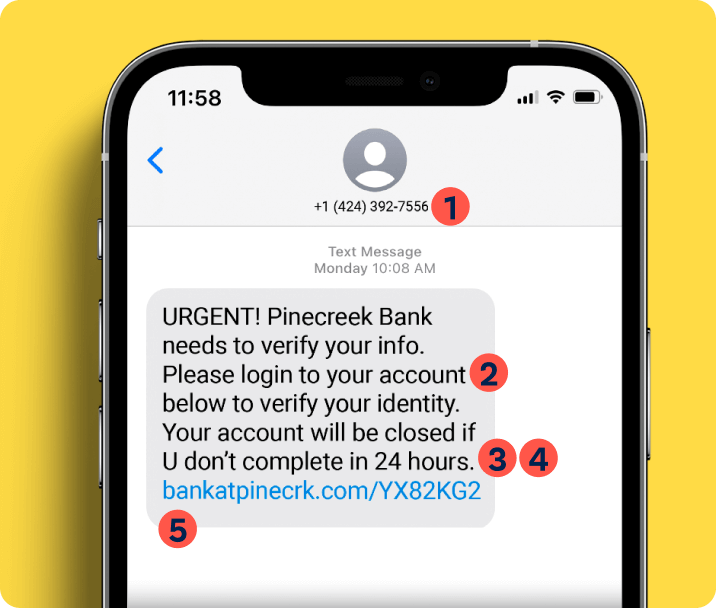

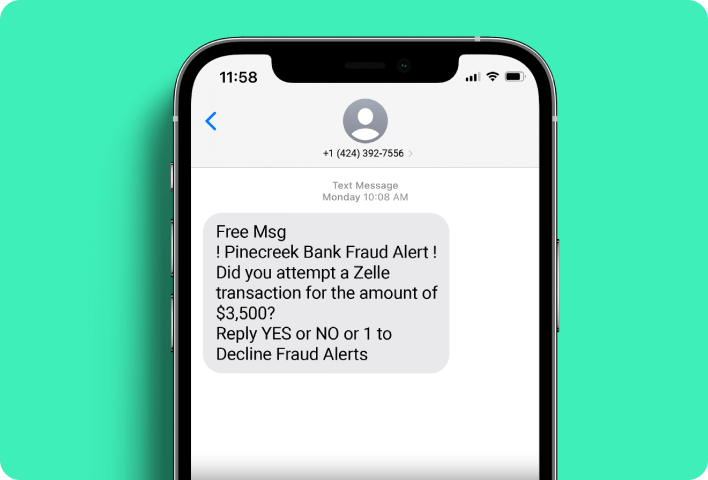

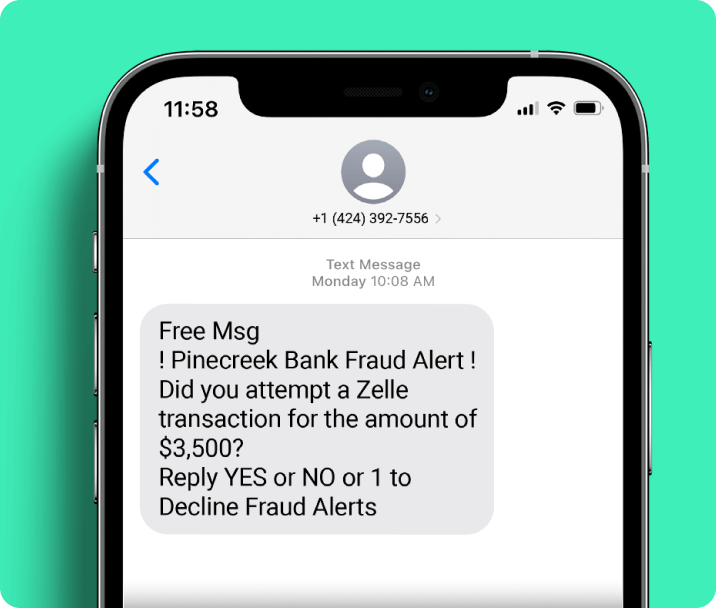

Text Scams

Strange Phone Numbers

Slow it down. Is that the number your bank usually uses to send text messages? Legit text message updates come from “short codes,” official 4-5 digit numbers used by your bank.

Urgent Warnings or Requests

Take a breath. Phishing texts try to create a sense of panic, such as threatening to suspend your account or urging you to log in to verify. Real bank texts won’t.

Odd Grammar or Spelling Mistakes

Spot check! If you see misspelled words or odd grammar they are all clear signs of an impersonator. Real banks use spell check.

Requests for Personal Information

If a text message requests personal or sensitive information, such as account numbers, PINs, passwords, or social security numbers, you can assume it’s a scam.

Suspicious Links

Banks rarely — if ever — send links via text. Don’t click them. Instead, verify the message by visiting your bank’s official website, or calling the number on the back of your card.

Text Scams

1. Strange Phone Numbers

2. Urgent Warnings or Requests

3. Odd Grammar or Spelling Mistakes

4. Requests for Personal Information

5. Suspicious Links

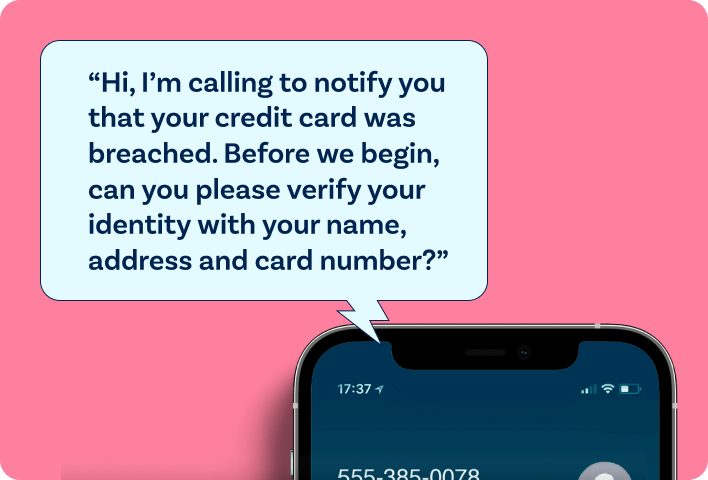

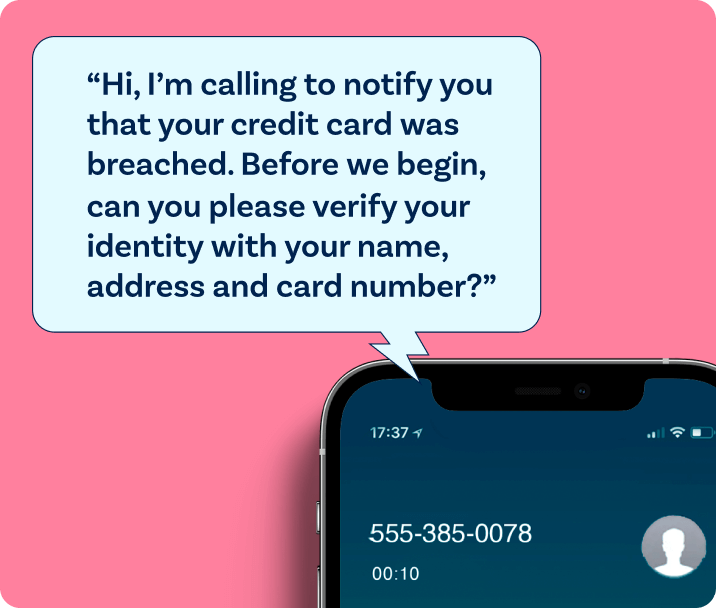

Phone Scams

Unusual Caller ID

While caller ID can be spoofed, legitimate calls from your bank are more likely to display an official phone number or a known identifier. If not, be very skeptical.Scare Tactics or Threats

Phishing calls rely on a sense of urgency. If the caller pressures you into immediate action or threatens negative consequences, just hang up and call the number on the back of your bank card.Asking for Personal Information

Banks will rarely ask for your account number, PIN, or password during a phone call — and will never ask for a one-time login code. Never share such confidential details unless you’ve called the number on the back of your bank card.Calling you unexpectedly

Be very skeptical of calls you receive out of the blue. Normally, bank representatives will only reach out if you initiate contact first. Stay safe by ending the call and dialing the number on the back of your bank card.

Phone Scams

Unusual Caller ID

Scare Tactics or Threats

Odd Grammar or Spelling Mistakes

Asking for Personal Information

Calling you unexpectedly

Payment App Scams

Unexpected Requests

Be cautious if you receive unexpected requests from strangers or organizations asking you to send money through a payment app. This is a scammer move.

Sending Money to Yourself

If someone who claims to be your bank says you have to send money to yourself, you can be 100% certain it’s a scam. Banks never ask that.

Overpayment Claims

Be skeptical if a sender claims to have accidentally overpaid you through Zelle® and requests a refund of the excess amount. Scammers use this tactic to trick you into sending them money.

Suspicious Links

If you receive a payment app-related message that contains a link, never click it. Scammers often send links to fake login pages to steal your username and password.

Pressure and Urgency

Scammers attempt to trick you by creating a sense of urgency. If they mention unforeseen emergencies, unverified transactions, account suspension, or unsolicited prize winnings, it’s a scam.

Payment App Scams

Unexpected Requests

Sending Money to Yourself

Overpayment Claims

Suspicious Links

Pressure and Urgency

Don't stop there. Spotting scams is just the beginning.

-

Beef Up Your Defenses

-

Got Scammed? Do This.

Strengthen your online bank account.

- Enable multi-factor authentication on top of your username and password.

- Use a strong and unique password.

- Update your software and devices.

- Use antivirus software on your computer.

How to respond if you’ve fallen for a scam.

- Contact your bank by calling the number on your card.

- Change your passwords and visit IdentityTheft.gov.

- Report the scam to the FTC here.

- If you lost money, file a police report.

Want an even deeper look into scam safety?

DO YOU PRACTICE SAFE CHECKS?

Stay one step ahead of scammers. Discover how to protect your checks and avoid fraud at PracticeSafeChecks.com